What the New Tax Law Means for You as an Individual

)

Manager

The One Big Beautiful Bill Act, Explained Simply

On July 4, 2025, a major new tax law was signed into effect: it’s commonly referred to as the One Big Beautiful Bill Act (the Act). This blog will focus on the impact the Act has on individual taxpayers. Head over to our blog on businesses to read about how these changes will impact business owners.

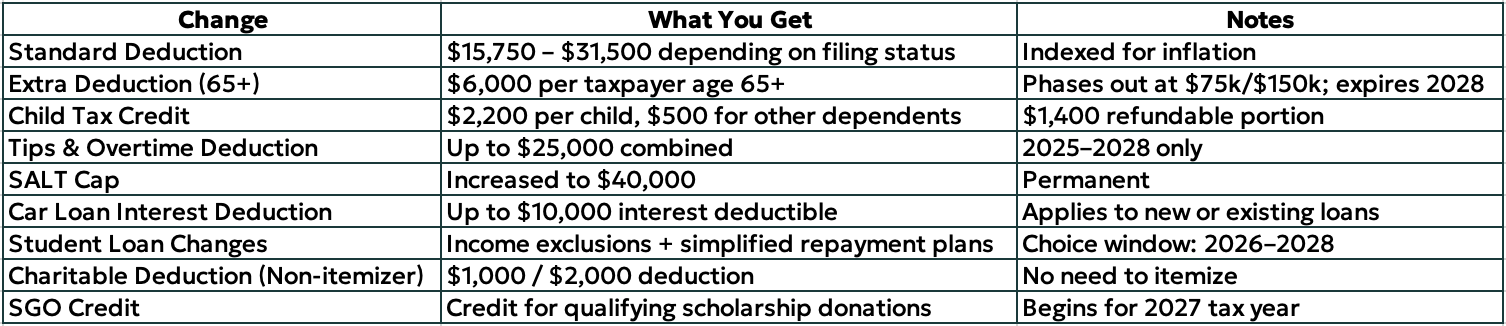

The Act brings changes that impact nearly every taxpayer—whether you’re retired, raising a family, paying off student loans, or working hourly shifts. Some deductions are back. Others are gone for good. And new opportunities are on the table.

We’ve laid it all out below. You can read the highlights or scroll to the table at the end for the numbers.

5 Quick Wins You’ll Like About the New Tax Law

Bigger child tax credit (and fewer phaseouts)

New deductions for tips and overtime pay

Extra $6,000 tax break for seniors 65+

You can now deduct car loan interest—up to $10,000

State and local tax (SALT) deduction cap increased to $40,000

Bigger Deductions for Everyday Filers

Standard Deductions Stay High

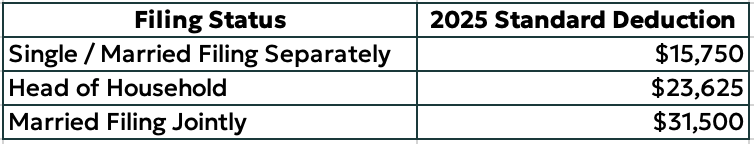

While the personal exemption remains permanently set to $0, the standard deduction continues to be generous—and is indexed for inflation:

Extra $6,000 Tax Break for Seniors (Age 65+)

If you're 65 or older, the Act gives you an additional $6,000 deduction—on top of your standard or itemized deductions.

This benefit phases out at:

$75,000 for individuals

$150,000 for joint filers

This extra deduction is temporary and will expire after 2028 unless extended.

Child Tax Credit Just Got Better

Parents will see some relief here:

The child tax credit increases to $2,200 per child

The refundable portion is now $1,400

You can claim a $500 credit for other dependents (like an elderly parent)

These provisions are now permanent, and the phaseout thresholds remain at:

$200,000 (individual)

$400,000 (joint)

Mortgage & Disaster Deduction Updates

The Act keeps a cap on mortgage-related deductions:

Mortgage interest is limited to the first $750,000 of acquisition debt

Home equity loan interest remains excluded

Mortgage insurance premiums are now deductible

Casualty loss deductions are expanded to include state-declared disasters, not just federally-declared ones

Student Loan Changes

Student loan debt discharged due to death or disability is now excluded from gross income.

The Act also simplifies repayment plans for new and existing borrowers:

RAP (Repayment Assistance Plan): 1%–10% of income, minimum $10/month over 30 years

IBR (Income-Based Repayment): 10% of discretionary income over 20 years

Standard Repayment: Fixed 10-year term

Borrowers must choose a plan between July 2026 and July 2028.

Loan limits for new federal loans:

Graduate students: $20,500/year (max $100,000)

Undergraduate students: $50,000/year (max $200,000)

New Deductions for Tips & Overtime (2025–2028)

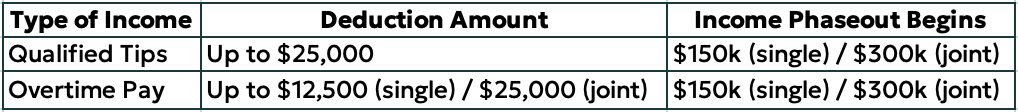

If you earn income from tips or overtime, the Act provides temporary deductions you may qualify for:

You can claim this even if you don’t itemize.

You Can Now Deduct Car Loan Interest

Yes, you read that right. The Act allows you to deduct up to $10,000 in interest paid on your car loan. But there’s a catch – your car must have undergone “final assembly” in the United States.

This is especially helpful for taxpayers who don’t itemize but still carry auto financing.

Big SALT Deduction Update

The State and Local Tax (SALT) deduction cap was increased:

Old cap: $10,000

New cap: $40,000

This is a significant benefit for taxpayers in high-income or high-property-tax states.

Estate Tax Exemption Locked in at $15 Million

For individuals thinking long-term—especially those planning to pass along wealth to future generations—the estate and gift tax exemption is a big deal.

Starting in 2026, the Act permanently sets the lifetime exemption at $15 million per individual (or $30 million for married couples).

This provides clarity and stability in estate planning, eliminating the looming threat of a drastic drop in the exemption that was scheduled under previous law. If you're approaching this threshold—or might be in the future—it's worth building or revisiting your estate strategy now.

New Tax-Free “Trump Accounts” for Saving & Investing

The Act introduces a new type of tax-advantaged savings option often referred to as “Trump Accounts.” These accounts are designed to encourage personal saving and investing—with some features similar to Roth IRAs but are intended for children and young adults, and they offer unique flexibility. The government will contribute $1,000 into a Trump Account for every baby born in the U.S. after January 1, 2025. We’re still waiting on more guidance on how to obtain these funds or apply.

That initial deposit can stay invested and grow over time, giving children a financial boost before they even take their first steps.

Here’s what we know so far:

Anyone can contribute, but the account must be opened in the name of a child under age 18

Contributions are made with after-tax dollars, but earnings grow tax-free

Withdrawals are tax-free when used for qualifying expenses

Early reports suggest these accounts may be used for retirement, first-time home purchases, education, or even small business investments

There are no income limits to contribute, making them attractive to higher-income earners

Contributions don’t count toward gift tax limits unless they exceed $18,000 per year (as of 2025)

Exact rules and contribution limits are still being finalized, but the general intent is clear: reward Americans who save and invest.

New Credit for Scholarship Donations

Contributions to Scholarship Granting Organizations (SGOs) now qualify for a tax credit, encouraging charitable support for student education. We’ve seen this on the state level. You can refer to this blog for more details on contributing to SGOs in Alabama. Taxpayers can start taking advantage of this credit on the federal level beginning in 2027.

New Charitable Deduction for Non-Itemizers

Even if you claim the standard deduction, the Act lets you deduct charitable gifts:

$1,000 for individuals

$2,000 for couples filing jointly

Quick Summary Table

What Should You Do Now?

This new law brings meaningful opportunities—but to benefit, you have to take action. Whether you want to:

Adjust your withholdings

Time charitable gifts for maximum impact

Reassess student loan repayment plans

Or plan for retirement or estate strategies under the new rules...

We’re here to help you make sense of it all.

At Aldridge Borden, we’re working closely with clients to apply these changes to real-life decisions.